The Study Committee on Aging recently published some alarming figures regarding the new pension reform. In its current form, the new measures would systematically widen the pension gap between men and women. By 2040, women are expected to see their pensions decrease by an average of 5.6 percent, compared to ‘only’ 4.3 percent for men.

Widening the Gap

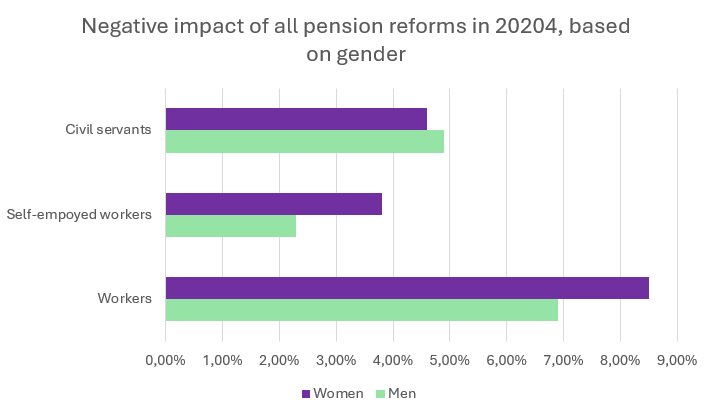

In its new report, the Study Committee on Aging analyzes each new pension measure and its estimated impact on the working population. The results speak for themselves: in nearly every employment category, women are disproportionately disadvantaged. Only in the civil service sector will men be more negatively affected than women, mainly because they currently benefit from more favorable conditions.

The Last Straw

That women will on average be more negatively impacted by the new pension measures only adds to the fact that they are already significantly disadvantaged in the current system. Just last year, the Federal Planning Bureau published a study showing that women receive on average 25% less pension than men. For every €1000 a retired man receives, a woman will receive on average only €750.

The causes of this gap are largely due to inequality in the labor market: women work part-time more often, perform a larger share of unpaid work, and have fewer opportunities for promotion or leadership positions. This inequality is no secret and is also reflected in a gender pay gap ranging from 7 to 20 percent. A worker’s salary not only directly impacts their pension (which is calculated based on income) but also limits their ability to save and financially prepare for the future. The current system therefore disadvantages women across the board. The new measures will only deepen this inequality.

Pension Poverty

The impact of a low pension is significant. Older people who were unable to build up capital during their careers and who are no longer able to participate in alternative labor markets (e.g., through flexijobs) are at high risk of falling into poverty. In 2024, the Federal Pension Service paid out a pension below the poverty line to four in ten women. That’s three times more than the number of men receiving pensions below the poverty line. Women are thus more vulnerable to poverty in old age, especially single women, who form the largest at-risk group.

Bridging the Gap

Fortunately, there is also some good news. New generations of retirees, combined with an increase in the minimum pension in 2024, have led to a decline in the figures. While in 2020, 16.2% of retirees were at risk of poverty, in 2024 this dropped to 10.7%. This encouraging decrease can be partly attributed to the emancipation of women and greater gender equality in the labor market. Still, it remains important to be aware of women’s vulnerable position in the job market. As long as inequality in the workplace is not structurally addressed, women will continue to be disadvantaged throughout their entire career. We therefore call on the government to adopt progressive measures that take gender differences in employment into account.

Want to learn more about financial inequality between men and women?

On Thursday September 18th, Amazone vzw is organizing a study day on the wealth gap in collaboration with Université des Femmes and Rosa vzw. Learn all about financial inequality between men and women in various areas (wages, pensions, employment opportunities, inheritance, etc.). Keep an eye on our social media for the full program!

From Thursday September 18th to Saturday September 20th, our annual feminist festival will also take place. This year’s theme is economic violence. Thanks to a diverse program, you can attend various talks and conferences, as well as participate in workshops and labs. More info at amazone.be or via our social media channels.

Sara-Lynn Milis

Projects & CRFG